From the time FBR has introduced electronic method of filling annual Income tax return for the taxpayers a new problem has been experienced by some taxpayers that either taxpayer forget his/her password of FBR (IRIS) account or if their registration is done by their consultant they black mail them either by increasing invoice or retaining them by saying that they do not have any separate account instead they file their returns through consultant’s intermediary account which is highly unethical and non-professional.

For salary and business individuals FBR has eased the registration and password retrieval procedure, while sitting at your office desk or at the ease of drawing room you can reset your ID password for FBR (IRIS) account.

Essentials for retrieving password;

- Cell number at which your account is registered (the one you provided to you consultant for registration purpose)

- Email address at which your account is registered

Step 1 – Go to the link IRIS login screen https://iris.fbr.gov.pk/public/txplogin.xhtml

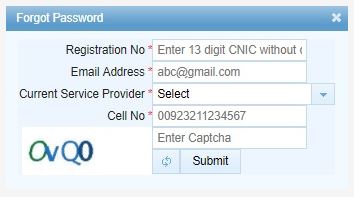

Step 2 – Click the “Forgot password” option below

Step 3 – Now a new dialogue box will appear before you fill in the details required

Step 4 – After filling the required information in the above dialogue box click the submit button and wait for the six digit verification code from FBR, the code will be send to both your cell number and email address.

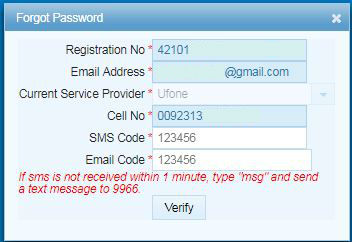

Note here that if you do not receive code within one minute as per the guidance give in the dialogue box type “msg” and send a text message to 9966.

Step 4 – After filling the 6 digit code that you received on your cell number and email click the “verify” button and you will have “New password” dialogue box appeared before you.

Note here that keep your new password alpha numeric and with lower and upper case letters e.g. Abc#1 it will be more safe and easy to remember.

With this you have reset your password for FBR (IRIS) account without any hassle. Do not let any consultant black mail you for this and always keep your ID and password for all FBR account with yourself as well and try to access your FBR account time to time.

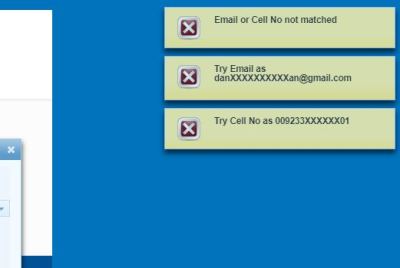

If in case you have forgotten which email address and cell number were used, IRIS provide cheats at the top on the right hand corner where you can find out the email and number which were used at the time of registration.

If you don’t recognise the provided cheat as your email or cell number (may be because your consultant or the person registered you on FBR, used self created email or cell number). Even than you don’t have to worry just go to nearest RTO with your original CNIC and at the help desk the representative of RTO (FBR) will reset your password on you new provided email and number.

Sir I am also the victim of password misuage by my tax consultant. He asks money of rupees 3 to 5000 for giving me my own password which he registered on a FBR website while providing his own cell number and email id therefore I could not reset my password online and I don’t have much time to visit RTO office due to my busy office job. Please provide me some other solution for resetting my password without having these required information.thanks

LikeLike

Greetings, Fiaz

Relax there are always right ways to do things, all you need to do is to authorize a representative or any one from your relatives (blood relations are recomended), and send them with your CNIC copy, authority letter, your cell number (on which you can easily recieve six digit code from FBR) and your personal email. FBR’s help desk will straight away resolve your matter and will provide a new password for your IRIS account, and later on you can change that.

If you need any further assistance in this or in any other matter you can contact me on twitter talalhassan_me or on facebook

LikeLike

Is RTO charging any fees or any charges for to retrieve the password /pln. Pl guide.

LikeLike

No not at all, they will provide this service free of cost. Do not get into any trap.

LikeLike

Sir

You mentioned Cheat on the top of right hand side in Iris. Couldn’t find it.

Plz guide how to recognize it. My husband forgot cell no and email address.

Regards

LikeLike

Actually Naila, now even you can find those details in your NTN verification online. Go to e.fbr.gov.pk take cursor to third option of “Search Taxpayers,” there click thrid option in dropdown menu “NTN Inquiry”. There select the parameter CNIC, type you CNIC and after typing verifying (captcha code) you can find your NTN details, their will be cheat of your email and number used to create IRIS account.

LikeLike

Found cheat but some digits are in staric form. Couldn’t identify . Is it possible to reset password without giving email address?

LikeLike

Ms. Naila you can read the response to the comment Fiaz Nawaz, even after that you need assistence you can provide your contact details in the link below, my associate can assist you in this.

https://talalhassan.me/contact-me/

LikeLike

i have been posted abroad on official duty and only few days are left for deadline to submit my IT return I have forgotten my password I have access to my registered e mail but phone is out of service what can I do to reset my password

LikeLike

Greetings, Ameer

What you can do, you can hire any tax representative to represent your case before taxation authority or you can send one of your relative(blood relation recomended) with copy of your CNIC, Authority letter, Email and cell number and FBR help desk will resolve your query.

If you want further guidance you can contact me on twitter and facebook.

LikeLike

I am unable to submit my e filing as when ever I select period of declaration form 114(1) it says transaction not allowed as workflow rule has failed

LikeLike

Greetings Amerr,

Please see if there is any notice in your Inbox if yes kindly reply to that notice. Then you can file you return for desired tax year.

For any further query you can contact me through twitter or facebook account or you can use contact form.

LikeLike

I am also a victim of fraud. His name is babar

email: babaraliandco@gmail.com

mob: 03107768226

please be aware of this fraudia

LikeLike

how to retrieve password for private limited company

LikeLike

Ahmed, actually for private limited companies, FBR do not to retrive password by the management themself, instead they ask management to authorise a person to request FBR help desk for passwor retrival along with necessary indentification documents.

For any furthet information you can contact me through twitter or contact me form in this website.

LikeLike

I am an active tax payer. I was able to file my tax returns before but now I am unable to login to my iris account. And when I click and forgot password and enter my CNIC there, an error displays that User is not registered.

However I am an active filer until 2018. What is the problem and how can I solve it?

LikeLike

Ahmad you can provide your details in contact me form, we can check your status by your details;

https://talalhassan.me/contact-me/

LikeLike

I have sent you my details. Please check

LikeLike

how to retrieve a password of AOP without using iris

LikeLike

I have heard that if you are Overseas Pakistani you can register on IRIS without declaring any assets because you are Overseas Pakistani so TAX is not apply on you?

LikeLike

Ammar if you can give any reference to this news then it will be easy to comment on but till now this is not in my knowledge.

Further there is no tax on your wealth statement. If you are referring to Amnesty scheme so that is over now.

LikeLike