FBR’s extension for POS integration

FBR extended the date for POS integration with FBR’s network up to August 31st, 2020. Retailers willing to integrate have to furnish in writing to respective RTOs/LTUs by August 20th, 2020.

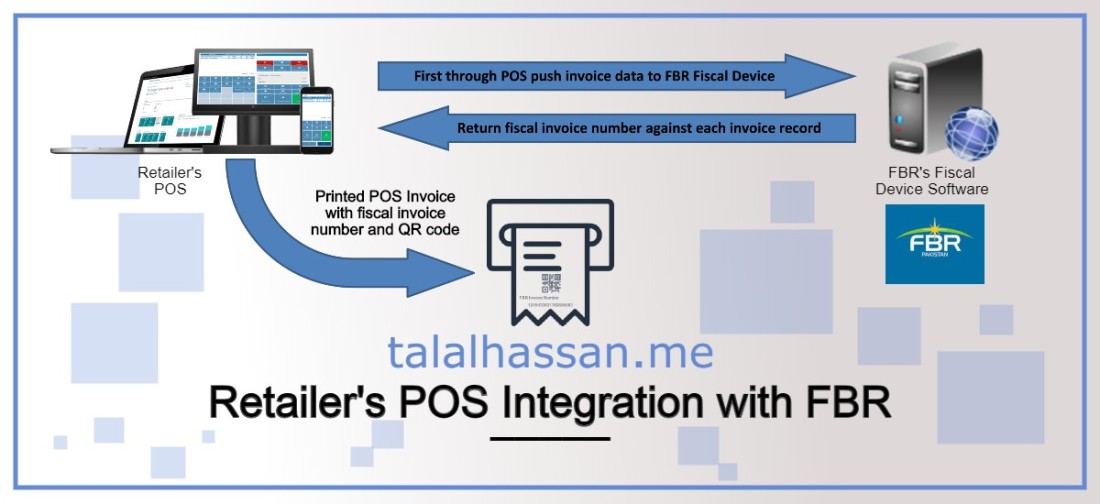

FBR continuously working on it’s systems to enhance the effectiveness of their machinery to achieve high efficiency in documenting the country’s economy and deterring tax evasion. Same as other sector’s in Pakistan, retailer’s (as per tax practices and FBR’s intelligence) were assumed to report much understated sales than in actual to evade sales tax. For this FBR Islamabad had also done some experiments by installing their own POS on the premises of some restaurants and other retailers, results were as expected, due to that FBR last year came up with the idea of integrated POS or real time invoicing systems. This system utilizes cloud technology for real time invoicing, as soon as the retailer enters the invoice through POS, in a glimpse of a second the information will travel to the FBR’s web service and return with a fiscal invoice number and a QR code, through which customer/consumer can verify using FBR’s Tax Asaan application.

This Real Time Point of Sale (POS) Invoicing System was introduced by the Federal Board of Revenue (FBR) initially for top Textile & Leather brands and was later expanded to Tier-1 retailers which include retail brands across Pakistan.

So, What actually POS Real Time Invoice System is?

Point of Sale (POS) Invoicing System by FBR is an online and real time invoicing system which connects the computerized Sales system of retailers with the Federal Board of Revenue (FBR) through the internet.

POS Invoicing System is the computerized & electronic system installed at different outlets in Pakistan which not only generates invoices for customers but also records sales data, manages inventory and maintains customer data.

By integrating these systems, the sale will not only be recorded in the internal system of the retailer but also at the network of FBR which ensures the collection of Sales Tax.

How To Integrate with FBR’s POS Real Time Invoice System?

FBR have kept the whole process of integration very simple for the ease of retailers as there is no need to purchase new machines or equipment. Rather they can use their existing invoicing system to complete the integration.

The integration can be completed successfully in the following steps:

- Login to the official website of FBR using your account details

- Select POS Client registration

- Provide details such POS Device Number, POS version, Business address, Branch details, City, IP address, Latitude and longitude

- Download Software Fiscal Device & Install on your POS Invoicing system.

- Register each point of sale at your business by the same process

Steps involved in installation of FBR POS Software:

To successfully integrate with FBR’s POS Real Time invoice system the retailer is required to install the software on all invoicing machines using the following process:

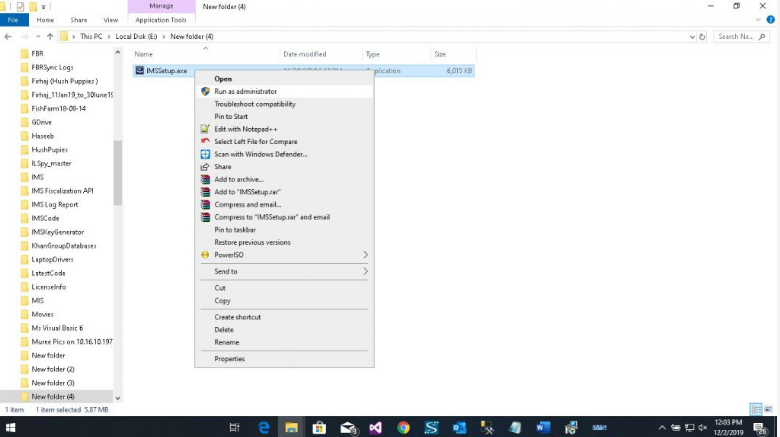

1) Download ‘Software Fiscal Device’ from the official website of FBR and run the software as administrator.

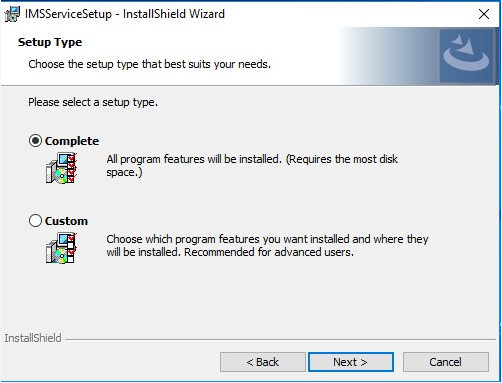

2) Select the ‘Complete’ Setup Type and proceed

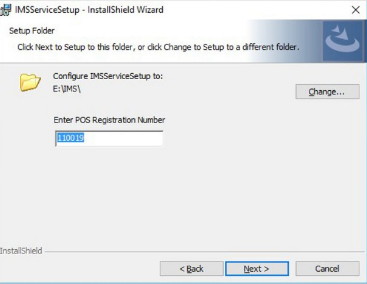

3) Select the target folder where you want to save the local files generated by the software and enter POS Registration Number which was generated on e.fbr.gov.pk

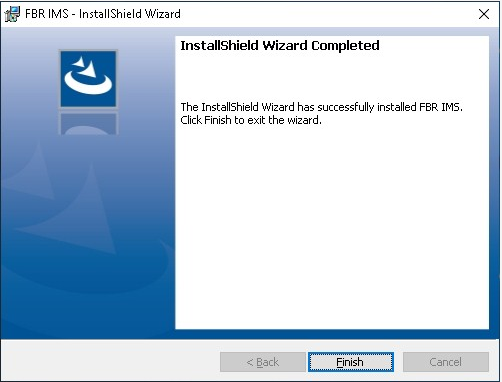

5) Click Finish to complete the installation

Following requirements for Software Fiscal Device include:

- Windows 7 or above

- .Net Frame Work 4.5 or above

- Internet Information System

By above measure FBR is confident that they will reduce the risk of sales tax evasion resulting in higher revenue collection. Some retailers have already installed above real time invoicing system by FBR including many international brands having outlets but still many resisting the system.

To encourage this integration of FBR’s network and retailer POS, taxation law provided concessionary sales tax rates on successful integration and penalties up to 1 million rupees on failure of integration. Continuous failure can lead to sealing of business premises with further reduction of input tax claim by 15%.

A quick summary of questions that people often ask;

Who falls under Tier-1 retailer?

Teir-1 retailer are defined by law as follows;

- A retailer operating as a unit of national or international chains of stores.

- A retailer operating in air-conditioned shopping malls and plaza but excluding kiosks.

- A retailer whose electricity bill exceeds 12 hundred thousand in last the 12 months.

- A wholesaler-cum-retailer who imports in bulk and supplies on both wholesale and retail basis.

- A retailer whose shop measures 1,000 Sq ft. or more.

Do bakeries, milk and sweet shops also fall under tier-1 retailers?

Bakeries, sweet and milk shops sell to the general public (consumers). Therefore if they meet the beside mentioned criteria they do fall under tier-1 and have to install and integrate POS.

Are restaurants also required to integrate POS?

Irrespective, whether restaurants or cafes fall under tier-1 they are required to integrate their POS with FBR’s network.

For any business/tax consultation in Pakistan, UAE and KSA you can write to me through contact me.

Related Reading

HOW TO RETRIEVE / RESET FBR (IRIS) ACCOUNT PASSWORD

Tax Refunds and Phishing Fraud